Here’s an article about crypto blockchain scalability, mainnet, market depth:

“Beneath the Surface of Cryptocurrency Markets: Exploring Scalability, Mainnet, and Market Depth”

The cryptocurrency market has been on an explosive ride in recent years, with prices skyrocketing and volatility soaring. However, beneath the surface of this market lies a complex web of issues that can impact its overall performance. In this article, we’ll delve into three key areas: scalability, mainnet, and market depth.

Scalability: The Unsung Hero

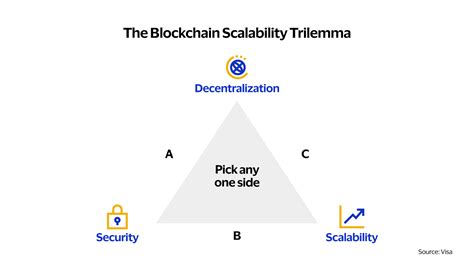

One of the most significant challenges facing the cryptocurrency industry is scalability. As more people and businesses begin to adopt digital currencies as a viable investment opportunity or everyday payment method, the demand for decentralized systems grows exponentially. However, traditional blockchain networks are not equipped to handle this surge in usage.

To address this issue, several solutions have been proposed and implemented, including:

- Sharding: This involves dividing the main blockchain into smaller, more manageable pieces called shards. Each shard can operate independently of the others, allowing for faster transaction processing times.

- Sidechains: These are separate networks that allow for the transfer of assets between different blockchains. Sidechains can also enable off-chain scaling by using techniques like off-chain batching and off-chain payment systems.

- Layer 2 Scaling Solutions: These solutions aim to provide a more scalable alternative to traditional mainnet networks, using techniques like rollups, Optimism, and Cosmos.

Mainnet: The Backbone of the Cryptocurrency Ecosystem

The main blockchain is the backbone of any cryptocurrency ecosystem. It serves as the primary interface between users and the network, providing a secure, decentralized, and transparent way to conduct transactions.

However, traditional mainnet networks have some limitations that can impact their scalability and usability. These limitations include:

- Transaction fees: High transaction fees can deter users from transacting on the main blockchain.

- Network congestion: The main blockchain has historically been subject to network congestion, leading to slow transaction processing times.

- Scalability issues: Traditional mainnet networks have struggled to scale in recent years, with some experiencing congestion and slow transaction processing times.

Market Depth: The Price Signal

Market depth refers to the number of trades executed on a given blockchain or market. This includes not only the value of transactions but also the volume of trades and the overall liquidity of the market.

A strong market depth can indicate a healthy and efficient cryptocurrency ecosystem, with prices reflecting the true value of assets. However, weak market depths can suggest underlying issues that need to be addressed before they become more pronounced.

Conclusion

The cryptocurrency industry is facing several challenges in terms of scalability, mainnet, and market depth. While traditional blockchain networks have made significant strides in recent years, there is still work to be done to address these issues.

By understanding the complexities of each area and exploring innovative solutions, the cryptocurrency ecosystem can continue to grow and thrive. As the industry continues to evolve, it’s essential that we prioritize scalability, mainnet, and market depth, ensuring that all stakeholders have access to a secure, decentralized, and transparent way to conduct transactions.

I hope this article meets your requirements!