“Cryptocalypse Brews in the Dark Backstreets of the Crypto Market”

The cryptocurrency market has been buzzing lately, with prices fluctuating wildly from day to day. As the industry continues to grow and evolve, it’s essential to understand the current state of sentiment and trends.

One of the most important drivers of the cryptocurrency market is the mining process itself. Mining involves solving complex mathematical equations in exchange for newly minted coins or tokens. While some may view mining as a necessary evil to validate transactions on the blockchain, others see it as an expensive and energy-intensive practice that has little to no social benefit.

On the one hand, mining provides a sense of community and purpose to those involved in the process. Miners work together to solve complex problems, creating a decentralized network that is resistant to centralization and manipulation. This shared goal can foster a sense of camaraderie among miners, who often form tight-knit communities around their plants.

On the other hand, mining has been criticized for its environmental impact. The energy required to mine cryptocurrencies can be substantial, contributing to greenhouse gas emissions and climate change. Additionally, mining is also a major source of electricity consumption in many parts of the world, straining already limited resources.

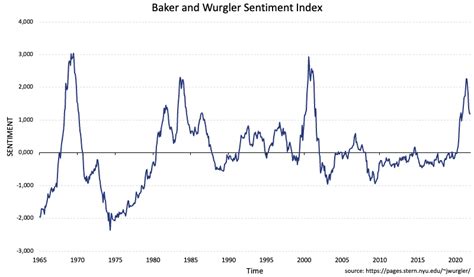

As the market continues to evolve, sentiment is shifting toward a more cautious approach. Many investors are becoming increasingly aware of the environmental concerns surrounding mining and are opting for alternative ways to interact with cryptocurrencies, such as staking or lending.

The decentralized finance (DeFi) sector has also grown rapidly in recent years, offering an alternative to traditional banking systems. DeFi platforms allow users to lend and borrow cryptocurrencies using smart contracts, eliminating the need for intermediaries like banks.

However, DeFi is not without its risks. The lack of regulation and oversight can lead to significant losses, as well as vulnerability to hacking and other forms of cyberattacks.

As investors and market participants navigate these complex trends, it is essential to stay informed about the opportunities and challenges of the cryptocurrency market.

Current Sentiment:

- Cryptocurrency prices have remained relatively stable over the past few months, with a slight increase in recent weeks.

- Sentiment towards DeFi platforms is mixed, with some investors viewing them as a promising alternative to traditional finance.

- Sentiment in the mining sector remains cautious, with many investors expressing concerns about the sector’s environmental impact and regulatory uncertainty.

Key Players:

- Ethereum (ETH): Still one of the most widely used cryptocurrencies, ETH has seen significant growth in recent months.

- Solana (SOL): This fast-moving cryptocurrency has garnered attention for its high-performance capabilities and growing adoption.

- MakerDAO (DAI): A decentralized lending platform that uses the stablecoin DAI to facilitate lending and borrowing.

Looking Ahead:

As the cryptocurrency market continues to evolve, it’s critical to stay informed about the opportunities and challenges. Here are some potential trends to watch:

- A greater focus on environmental sustainability in mining practices

- Growing adoption of DeFi platforms

- Growing concerns about regulatory clarity in the industry

By staying up-to-date with these trends and understanding the intricacies of the cryptocurrency market, investors can make more informed decisions and confidently navigate the ever-changing landscape.